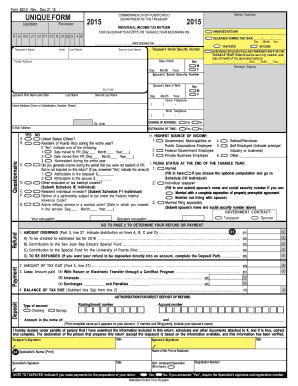

PR 482.0 2018-2025 free printable template

Get, Create, Make and Sign puerto rico return pdf form

Editing puerto rico income return online

PR 482.0 Form Versions

How to fill out puerto rico individual return form

How to fill out PR 482.0

Who needs PR 482.0?

Video instructions and help with filling out and completing pr 482

Instructions and Help about puerto rico 482 0 return

The 402 visa is the main Australian temporary work visa for employers to sponsor workers from overseas hello I'm Chris Johnston from work visa lawyers the new subclass for a — TSS visa has replaced the subclass 457 visas much more information on the 482 visa can be found at our website on work visa lawyers comm dot a forward slash news if you find this video useful please hit the subscribe button the ten things are we mentioning today are the stages and the streams of the TSS visa labor market testing training requirements and sponsor obligations genuine need for the position the annual market salary rate or AMS our visa applicant requirements including skills assessment and work experience requirements the need to provide complete documentation TSS visa holders and the implications of school fees and giving birth in Australia the alternatives to the 482 visa pathway to Australian PR one the stages in the TSS visa program are the same as for the previous 457 visa the three stages are sponsorship nomination and visa application employers will have to be an approved business sponsor by submitting a sponsorship application then the business nominates a position in the business that needs to be fueled by a nominee or visa applicant the visa applicant then submits the subclass for act 2 visa application you can still submit all three stages of the application at the same time however you will need to complete the labor market testing and skills assessments before submitting your applications next we talk about the different streams available for the TSS visa the streams available are the short term long term and labor agreement streams I'll be providing details about the short term and long term streams if you are applying in the short term stream your 402 visa will be valid for two years unless international trade obligations apply if applying through the long-term strain your 402 visa will be valid for four years you will then be able to meet permanent resident employer-sponsored visa requirements which are not available to two-year visa holders the stream you are applying for depends on the nominated occupation if the nominated occupation is on the short term list you will be applying under the short term stream if your nominated occupation is on the medium-term list you'll be applying under the long term stream you should note that if you're applying under the short term stream you will need to meet genuine temporary entrance or GTE requirements to the labor market testing requirements while there are many requirements for labor market testing the most important features include advertising at least two instances or mediums running the job ad for at least 21 days and mentioning the salary of the position in the advert you may be exempted from labor market testing if international trade obligations apply item number 3 the training requirements and sponsorship obligations the TSS visa program will no longer utilize training benchmarks A or B which...

People Also Ask about puerto rico form 4820

What is 1040 PR in English?

Who must file a tax return in Puerto Rico?

Do Puerto Ricans file 1040s?

What is a Puerto Rico Form 480.6 C?

Do citizens of Puerto Rico file US tax returns?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pr 482 fillable without leaving Google Drive?

Can I create an eSignature for the pr form tax in Gmail?

How do I fill out the puerto rico 482 0 return printable form on my smartphone?

What is PR 482.0?

Who is required to file PR 482.0?

How to fill out PR 482.0?

What is the purpose of PR 482.0?

What information must be reported on PR 482.0?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.